Vertex Protocol - Better Than CEX

A guide to Vertex, what it is, why it's needed, and how you can profit from it

Since the collapse of FTX and the loss of billions in customer funds, not to mention the recent SEC action against Binance and Coinbase, the case for on-chain transparency and self-custody you get from decentralized exchanges has never been more apparent.

However, despite DEXs gaining some ground in spot trading, 80-90% of spot volume still goes through centralized exchanges. And perps volume over 97% still goes through CEXs.

With the inherent and post-FTX, now obvious risks of custodial centralized platforms, why do most investors, traders, and institutions still use them?

For retail, it's simple; DeFi, with fragmented functionality and products split between multiple platforms, is complex and time-consuming.

And this lack of vertical product integration also impacts advanced traders and institutions, making it difficult to perform advanced trading strategies, especially when execution speed is so slow compared to centralized platforms.

Most DEXs have aimed purely to compete with other DEXs, instead of fixing the issues that keep the majority of volume on CEXs. Consequently, they only attract existing DeFi users from other DeFi platforms; they don't bring new users into the on-chain ecosystem.

But one new platform aims to change this by solving the critical issues of latency and functionality while retaining the core benefits of DeFi: transparency and self-custody. And unlike centralized and most decentralized exchanges, you can get a share of their success.

What is Vertex Protocol?

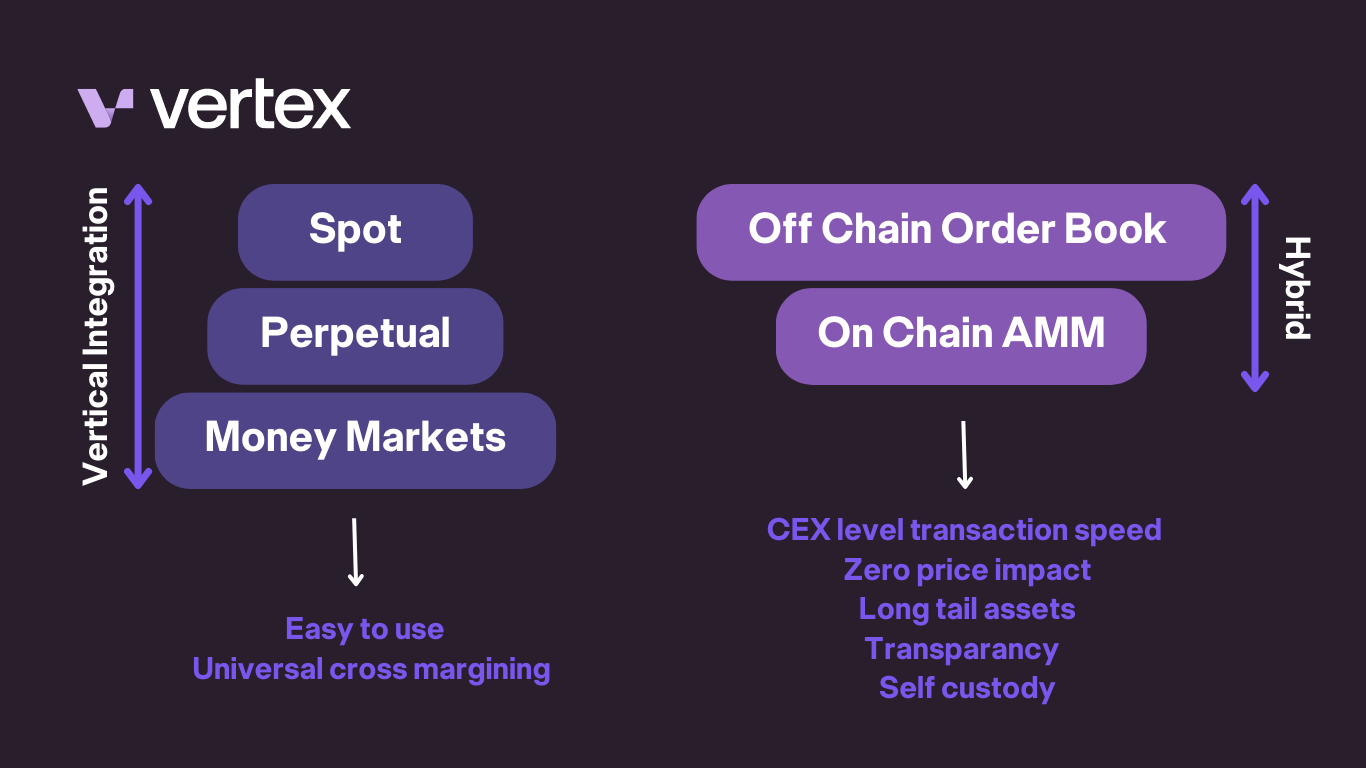

Vertex is a decentralized exchange on Arbitrum that offers spot, perps, and money markets all in one place, with CEX-level transaction speed. Vertical integration and high-speed execution combined with unique features such as universal cross-margining make this an attractive DEX for both retail investors and institutions.

So with CEX-level performance and features, but with on-chain transparency and user self-custody, Vertex is ready to take on both decentralized and centralized platforms.

How does Vertex compare to CEXs?

Like best-in-class centralized exchanges, Vertex has a vertically integrated suite of the core crypto trading products: spot, perps, borrowing, and lending. And this vertical integration has allowed them to add universal cross-margining to their platform, something which even Binance doesn't have.

Cross-margining allows the margin from one or more well-performing positions to be used by underperforming trades, meaning less margin needs to be assigned for each position, providing better capital efficiency. And while rare in the DeFi space, cross-margining is a popular feature on centralized platforms. However, cross-margining is limited to one particular type of trade, either spot or perps; you can't utilize the margin between the two, and you can't use money market capital or liquidity pool tokens as collateral. However, with universal cross-margining, you can.

Vertex's universal cross-margining capabilities make advanced trade strategies such as basis trading and pair trading much more manageable and set it apart from other decentralized exchanges and centralized platforms like Binance.

So having all the core trading products in one place makes Vertex as easy and attractive as a CEX for retail users. And universal cross margining offers some unique options for advanced traders.

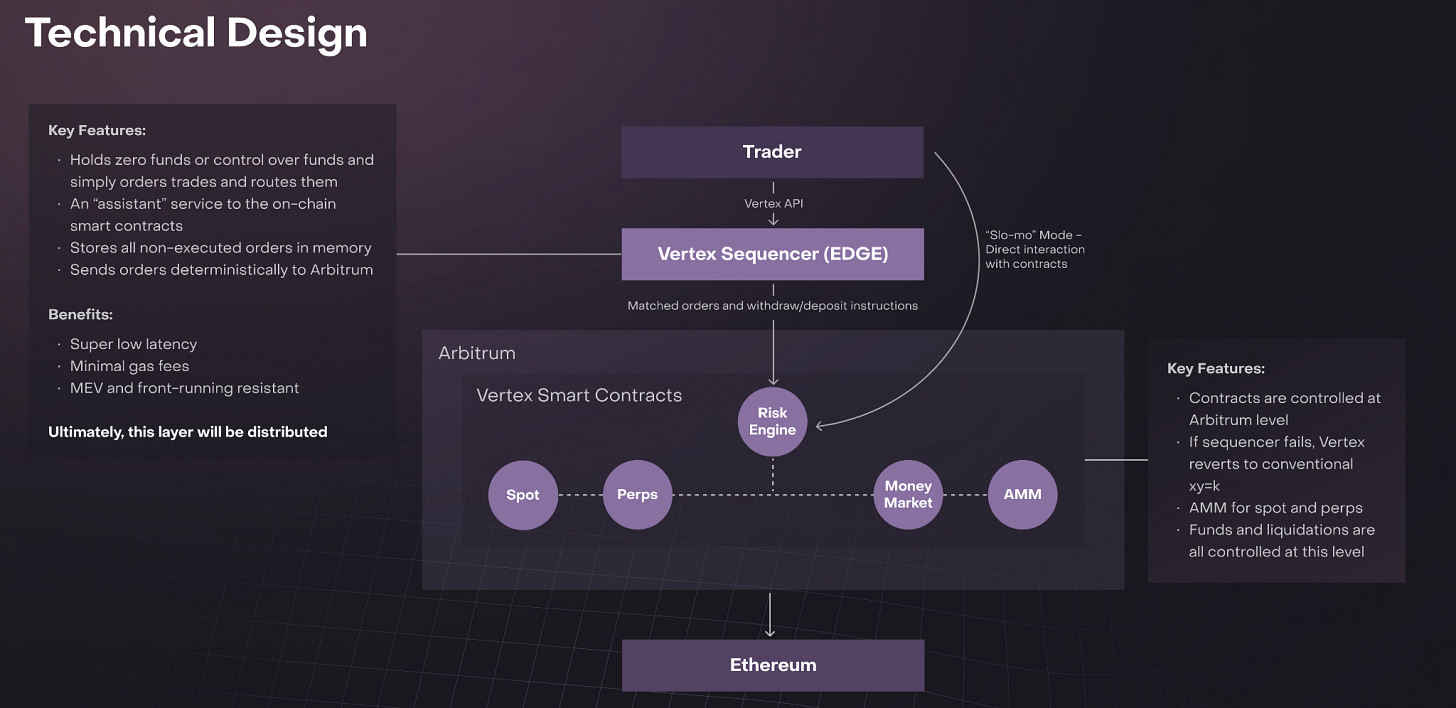

But Vertex hasn't stopped there; one of the critical problems with DeFi is that it is incredibly slow, making time-sensitive trades almost impossible, another reason institutions and whales still use CEXs. To solve the speed dilemma, Vertex has an off-chain order book built into their Edge sequencer and an on-chain AMM working side by side, allowing transaction execution in under 30ms, which competes with the top exchanges in crypto.

The Edge sequencer automatically picks the best price between the order book and the AMM, with the AMM effectively acting as another market maker. The order book not only provides CEX-level execution speeds and the best available price for trades but also stops another major issue with DEXs: price impact.

The AMM also allows Vertex to list lower liquidity assets that would be difficult to support with the order book alone. And it acts as a backup for trading should there ever be an issue with the sequencer.

Effectively the order book gives you the speed of execution you get with a CEX, while the AMM allows Vertex to list assets a CEX couldn't support. And all transactions are finalized on-chain, providing essential DeFi transparency and self-custody.

The only downside compared to a centralized exchange is that it's impossible to buy non-ERC20 tokens, for instance, instead of Bitcoin you have to buy wBTC. Undoubtedly this will pose a problem for Bitcoin, Cardano, and Solana maxis. However, how many maxis are likely to use an EVM chain?

CEXs make incredible amounts of revenue from trading fees and liquidations because they currently control the majority of crypto volume and don't share any of that revenue with the likes of us. But Vertex looks poised to steal some of that volume, and they will share revenue through their VRTX token.

How does Vertex compare to other DEXs?

Decentralization maxis could argue that with its off-chain order book, Vertex doesn't qualify as a DEX. But then the same could be said of dYdX, which hasn't stopped them from becoming the biggest on-chain perps exchange by volume, and they only run the order book, not an AMM/order book hybrid.

Whitelisting on the user interface is also very centralized, meaning that projects can't automatically list on Vertex, so you're unlikely to see the latest degen tokens there. So while Vertex can list more tokens than your average CEX, it won't list anywhere near the number of tokens you'd see on the biggest DEXs. But is that such a bad thing?

For Vertex to compete with CEXs, compromises must be made, particularly when execution speeds on Ethereum DEXs are over 13 seconds and L2 DEXs over 1.3 seconds. And the AMM/order book hybrid gets the best of both worlds, centralized performance combined with on-chain finality, transparency, and self-custody. The alternative is the majority of retail investors, and institutions stay on centralized platforms.

And in terms of whitelisting, it's arguable investors, particularly those migrating from CEXs, need protection from riskier projects and potential rugs. Those people who want degen tokens have plenty of other avenues.

Vertex doesn't replace other DEXs but fills the gap between them and CEXs.

VRTX

Most native protocol tokens have no real buy catalysts; UNI you get a governance token with no underlying value; dYdX, you get governance and cheaper trading fees, so unless you're trading some serious volume again, it's pointless.

But revenue sharing or real-yield has been on the rise for some time, and it has catapulted tokens such as GMX into the top 100 coins. Despite dYdX doing 10x the volume on GMX, the GMX token market cap is 1.3x the size, and that is the power of real-yield.

So imagine a protocol that can match dYdX in performance but beats it on functionality while rewarding token holders with a share of revenue; what would their token be worth? We'll soon find out when VRTX launches.

How can you get exposure to VRTX?

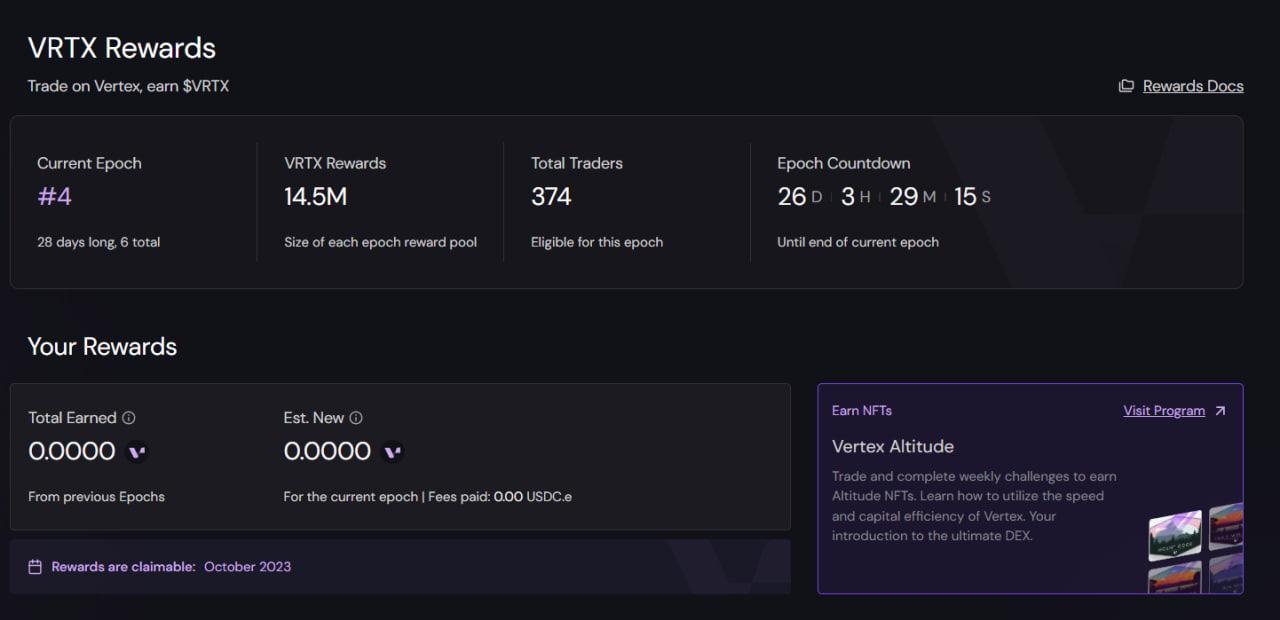

Until the VRTX token launches, the only way to get exposure is by using the Vertex platform, either trading spot or perps.

To encourage traders to use the platform, Vertex set up a reward system. VTRX rewards are distributed proportionally to each trader's trading fees during an epoch. 9% of the total VRTX supply is available in the genesis period, which ends in October, then the ongoing emissions phase kicks in with a further 37% distributed over five years

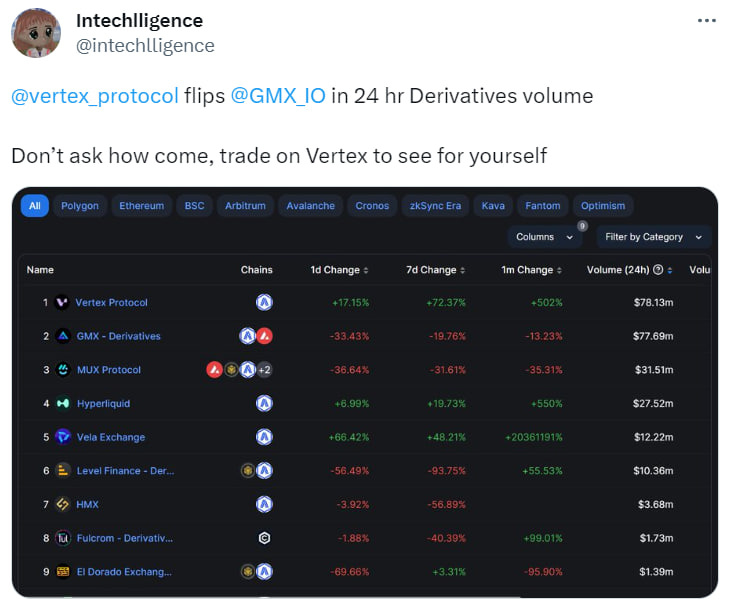

So far, the rewards system has been a massive success, with Vertex briefly flipping GMX and nearly every other on-chain perps platform within the last few days.

Upside potential

With CEXs owning 80 to 90% of spot volume and over 97% of derivatives volume, the potential for a platform that can compete with and beat them in terms of vertical integration, functionality, and performance is enormous. It's even more significant when you consider that users won't have to compromise on transparency and self-custody.

Uniswap only does 1/10 the volume of Binance for spot trading, but its UNI token has a market cap of $4.6 billion. dYdX, the biggest on-chain perps platform, only does 3% of the volume of Binance, yet its dYdX token has a market cap of $376 million. And neither of these tokens share revenue with their holders.

GMX, on the other hand, does share revenue and has a market cap of nearly $500 million. But as we've already discussed, Vertex is already competing with them in volume in less than four months.

So, VRTX is destined to have a huge market cap, but how much upside that will give early holders will depend on whether they've got it through rewards or bought at launch. And it will depend on the starting price at launch.

For my taste, Vertex has almost done too well, too early, and consequently, I suspect the starting market cap will be very high. And even if it's not, it will be a very crowded trade come launch, so this will limit the overall upside.

However, Vertex has incomparable product market fit, perfectly placed to become one of the top decentralized exchanges and one of the top crypto exchanges full stop. And in a bull market environment, with volumes and revenue soaring, there seems to be no limit to how far VRTX can run.

Pros

CEX-level transaction speeds

Zero price impact

On-chain transparency and self-custody

All the core crypto trading products: spot, perps, and money market, vertically integrated

Universal cross-margining

Easy-to-use user interface

Integrated on and off ramps

Low trading fees

Rewards system for trading

VRTX token will get a share of revenue

API for institutional trading software

Can support lower liquidity tokens

Whitelisting protects users from riskier assets

Backing from major institutions such as Jane Street and Wintermute

Already achieved significant perps trading volume

Cons

The sequencer and order book are a centralized compromise

Whitelisting is a centralized element

Whitelisting will limit the number of tokens available

Unlike CEXs, only ERC20 tokens can be bought and sold

Limited spot and perps options currently

No announcement on VRTX launch price

If you plan on trading through Vertex, please use my referral link. You get a 10% VRTX boost, and so do I 🤝

If you enjoyed this article, please subscribe, follow The Metaverse Guy Twitter account, and join my Telegram channel, The Metaverse Guide.

*Disclaimer: this is not financial advice; always do your own research. I currently am only eligible for a minuscule amount of VRTX from rewards; however, I do intend on investing at or shortly after launch*